Forecasting the growth of steel demand for wind turbines from 2023 to 2032

Steel NewsDate: 20-12-2023 by: Ngan Le

The global steel demand for wind turbines industry is expected to experience a significant surge of 45% over the next decade, driven by the escalating capacity and size of turbines. Specifically, the projected consumption output within the industry is anticipated to rise from 10.5 million tons in 2023 to 15.1 million tons by the year 2032.

The trend in the steel demand for wind turbines sector in next decade

Steel has long been the primary material for constructing wind turbines due to its strong structural properties and corrosion resistance. Consequently, with the increasing shift towards renewable energy, the rising global steel consumption in the wind energy industry indicates a clear signal. As of 2023, the steel demand for wind turbines stands at 10.5 million tons and this figure is projected to surge by 45% in 2032 due to the growing capacity and size of turbines.

Data on the development of wind turbine sizes is annually documented. According to this information, the average size of onshore and offshore wind turbines in projects recorded from 2019 to 2022 was 2.9MW and 6.2MW, respectively. In 2023, these figures experienced a significant increase, reaching 4.3MW for onshore and 9.2MW for offshore turbines. Notably, in offshore wind turbine projects, industry manufacturers are currently aiming to introduce the next generation of turbines with an average capacity ranging from 15 MW to 20MW, which is double the current average capacity.

The steel demand for the offshore segment is believed to be significantly higher than that for onshore, with the steel consumption growth rate for onshore reaching only 32%, whereas for offshore, this figure rises to 101%. Typically, steel constitutes 80% of the composition of a wind turbine. However, offshore turbines require more steel. The reason is that the foundations of offshore wind turbines must be made of steel instead of concrete and cement used onshore because steel provides better corrosion resistance in a marine environment.

Predictions for steel consumption scenarios in wind turbine projects

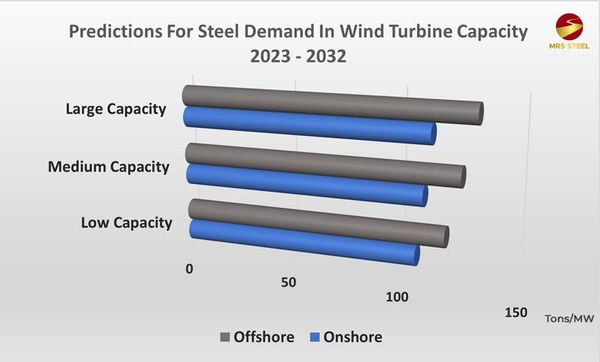

The production of larger turbines will entail a higher demand for steel. Therefore, the steel consumption in the wind energy industry is anticipated to grow significantly with the following predicted scenarios over the next decade:

Small Capacity Turbine Projects

Turbines classified under the small capacity category typically have a capacity of 2MW for onshore types and 6.2MW for those installed offshore. Among the installed projects, these turbines constitute the largest market share, yet they have the lowest steel consumption. Specifically, the total steel demand for wind turbines over the next 10 years, starting from 2023, is estimated to reach 124.8 million tons. This is equivalent to consuming 107 tons of steel per 1 MW for onshore turbines and 119.5 tons of steel per 1 MW for offshore turbines.

Medium Capacity Turbine Projects

The assumed scenario for the trend in steel consumption for medium-capacity turbines (3.45-5MW for onshore and 9MW for offshore) over the next decade is expected to reach 128.7 million tons. The projected steel consumption rate per MW is estimated to be 110 tons/MW for onshore and 125.8 tons/MW for offshore.

Large Capacity Turbine Projects

Over the ten-year period from 2023 to 2032, projects involving large-capacity turbines (6 MW-7.2 MW for onshore and 15 MW and above for offshore) are predicted to see rapid development, capturing a significant market share within five years, by the mid-decade. The total steel consumption for these projects is forecasted to reach 130 million tons, with a predicted steel consumption rate of 113 tons/MW for onshore and 132 tons/MW for offshore.

With the future deployment strategies of large-capacity wind turbines in the energy sector, the anticipated surge in steel demand is expected to create expanded opportunities for global steel manufacturers. This trend signifies a broader scope of consumption beyond traditional sectors such as construction and automotive. The renewable energy sector, particularly the wind energy industry, continues to be one of the top potential markets for steel consumption, with clear indicators of continuous growth. To gain further insights into the steel applications in wind turbines, please refer to additional articles in our Steel Blog!