Vietnam's HRC export volume exceeded 3.2 million tons in the 11 months of 2023

Steel NewsDate: 03-01-2024 by: Ngan Le

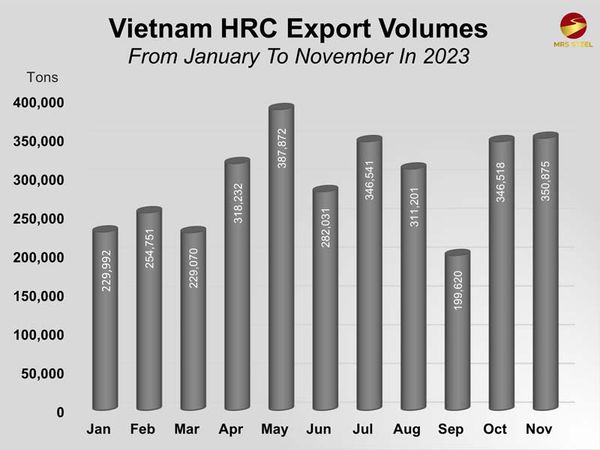

In the past November, the production of hot-rolled coil steel reached 555,162 tons, experiencing a slight decrease of 5% compared to October but witnessing a significant increase of 30% compared to the same period in 2022. Additionally, Vietnam's HRC export volume amounted to 350,875 tons, showing a slight uptick of nearly 2% compared to October, yet experiencing a remarkable twofold surge compared to November 2022.

Overview of Vietnam's HRC export situation in the 11 months of 2023

In general, during the first 11 months of 2023, the production of hot-rolled coil steel reached 6 million tons, showing a 6% increase compared to the same period in 2022. The nationwide HRC sales volume for the same period reached 6.2 million tons, marking a 7% growth compared to the first 11 months of 2022. However, the notable highlight lies in the HRC export sector, with a volume reaching 3.2 million tons, tripling the figure from the same period last year.

Formosa Ha Tinh and Hoa Phat continue to be the leading entities in the national HRC sector, with export volumes reaching 2,118,675 tons and 1,045,000 tons, respectively, during the 11 months of 2023. In general, the combined export volume of these two companies accounts for over 95% of the total HRC export volume this year. Specifically, Hoa Phat's HRC sales in November reached nearly 270,000 tons, with the export-oriented HRC reaching 118,922 tons.

Statistic of Vietnam’s HRC export volumes from January to November in 2023

Overall, there are signs of growth in HRC sales in the last months of the year, especially with the export-oriented HRC playing a crucial role in this increase, given the significant reduction in raw material prices and the gradual capacity increase in factories. Most experts believe that the steel industry has overcome its most challenging period, and signs of recovery are gradually emerging. The real estate market in China is stabilizing and becoming a bright spot for steel consumption in the construction sector.

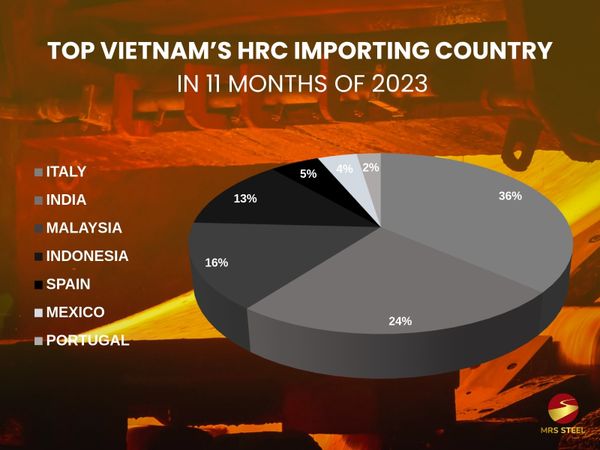

India and Italy are the two main import markets for Vietnam's HRC

Customs data also indicates that Italy and India are the two largest import markets for Vietnam's HRC in 2023. Italy, in particular, imported over 1 million tons of HRC from Vietnam in the first 11 months of 2023, making it the largest HRC importing country, capturing nearly a third of the export market share. Besides Italy, India became the second-largest importer of Vietnam's HRC, with a total imported volume of 674,472 tons during the 11 months.

India has been evaluated as a potential steel import market recently. Specifically, from September onwards, India has consistently surpassed Italy in leading the import volume of Vietnam's HRC. In November alone, India imported 140,633 tons, while Italy imported just over 79,000 tons. The World Steel Association (WSA) predicts that in 2024, steel demand in the EU and India is expected to recover by 5.6% and 7.5%, respectively, which is seen as positive for Vietnam's steel export, especially for HRC.

Top largest countries have Vietnam’s HRC importing volumes in 11 months of 2023

Furthermore, the list of over 40 countries importing HRC includes two Southeast Asian countries, Malaysia and Indonesia, ranking third and fourth in import volume, with 436 thousand tons and 361 thousand tons, respectively, in the first 11 months of 2023. It's noteworthy that among the top 10 countries with the highest import volumes of Vietnam's HRC, only two are from Southeast Asia, compared to previous years when Vietnam's steel sources were mostly consumed in this region.

The emergence of potential new import markets such as India, Mexico, or Spain somewhat reflects the strong determination of the Vietnamese steel industry to expand its scale to new major markets, especially under the impetus of bilateral trade agreements. The attractive prices offered by Vietnamese HRC manufacturers, along with the benefits of reduced export taxes from agreements such as EVFTA or CPTPP, have created significant opportunities for businesses in Europe and the Americas to increase imports of Vietnamese steel products.

The entire information in the article is updated and based on the latest customs data. If you need more detailed information about the weekly steel price list directly from the factories, please contact us via WhatsApp: +84 76 911 2358 or email vanloc@mrssteel.com.vn for the quickest response.