Nam Kim Steel's export volumes grew strongly in a series of key markets

Steel NewsDate: 22-12-2023 by: Ngoc Cam

Nam Kim's business activities are expected to benefit directly when steel demand in a series of key export markets is forecast to grow strongly in 2024.

1. Nam Kim steel exports will grow strongly by the end of 2023

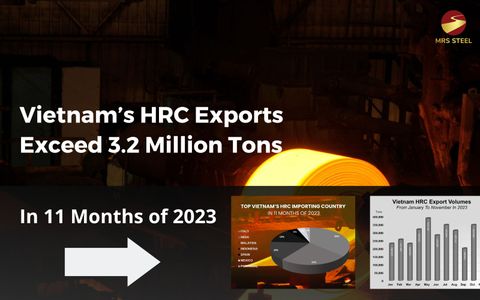

According to the latest report of the World Steel Association, global steel demand in 2023 is estimated to increase by 1.8% compared to 2022, a positive improvement compared to the decrease of 3.3% in 2022. In 2024, global steel demand is expected to continue to increase by 1.9%, reaching 1.84 billion tons with main export markets from the European Union (up 5.8% compared to 2023), India (up 7.7%) and the ASEAN region (up 5.2% compared to 2023).

This creates favorable conditions for several Vietnamese steel enterprises, especially Nam Kim Steel Joint Stock Company. NKG is one of the largest steel export brands in Vietnam with strength in galvanized steel products. More than 60% of the group's consumption comes from key markets such as the EU, ASEAN and Australia.

Besides, Nam Kim Steel is enjoying the lowest anti-dumping duty rate in many Vietnamese steel import markets such as Canada, Mexico, Australia and Malaysia.

Latest data shows that Nam Kim Steel's main export markets are all in the group with a positive recovery in steel output in the first 10 months of 2023 like the EU region (up 86.2% over the same period in 2022) and Australia (up 9.1%).

Regarding future development orientation, Nam Kim Steel is focusing on exploiting the EU, Australia, ASEAN markets, then the US due to barriers of tax rates of up to 25% as well as high Vietnam-US freight rates.

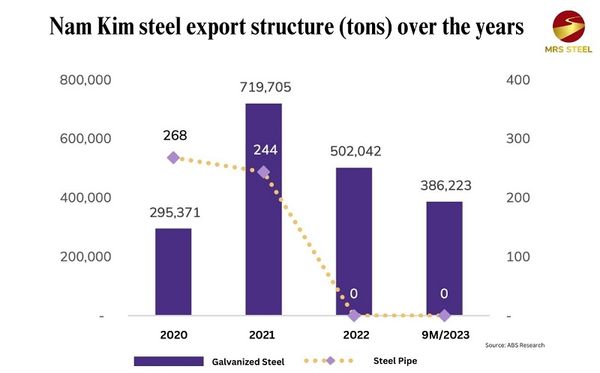

Currently, Nam Kim Steel is in the top 3 enterprises with the largest market share in Vietnam (accounting for 17.3%). Notably, for steel pipe products, Nam Kim Steel is experiencing continuous market share growth in recent years. In 2022, NKG's steel pipe consumption growth rate was 3 times higher than the growth rate of the entire industry, accounting for 7.4% of the entire market share.

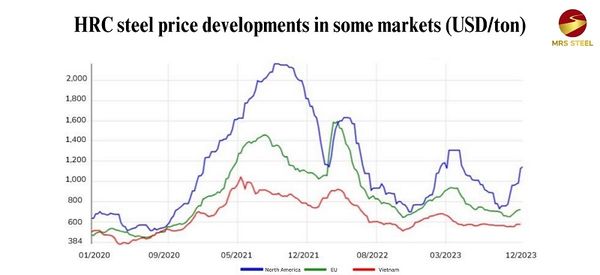

2. Vietnamese steel benefits from the gradual recovery of steel prices

The business activities of Nam Kim in particular and steel businesses in general will continue to benefit from the recovery in domestic steel prices. After 19 consecutive price reductions in the first 9 months of 2023, steel prices of all types in Vietnam have begun to recover with 3 consecutive price increases since the end of November 2023. The Vietnam Steel Association (VSA) predicts that domestic steel prices may increase slightly in the near future with a range of 100,000 - 150,000 VND/ton.

The reason for the increase in domestic steel prices comes from the increase in input costs (iron ore, electricity, steel scrap,...) along with a clear increase in world steel prices. Hot rolled steel prices in the US and EU from the beginning of October 2023 have increased by 1,146 USD/ton and 727 USD/ton, respectively. World construction steel prices also increased dramatically in early November 2023 when they surpassed 3,800 CNY/ton.

Global steel prices increased mainly due to limited steel supply and prolonged delivery times due to the impact of military and political conflicts. At the same time, a series of steel furnaces in the EU temporarily stopped operating for maintenance while steel demand is still increasing. In addition, the Chinese government also promotes recovery of the real estate market, boosting demand for steel in the near future.