Outlook for the global and Vietnam steel market in 2023

Steel NewsDate: 11-10-2023 by: Ngoc Cam

2022 is a tough year for the world steel industry in general and Vietnam in particular because of the effects of the Russia-Ukraine war, high inflation and interest rates as well as China expanding lockdowns as Covid-19 epidemic. According to the forecast of the World Steel Association, steel demand and price in the world in the first half of 2023 will have significant changes. In this article, MRS Steel will dive deeper into the situation of Vietnam's steel industry and key steel producing regions in the world today.

1. Vietnam steel prices tend to decrease

According to a recent report of the Vietnam Steel Association (VSA), the price of construction steel has just decreased by 270,000 VND/ton, the lowest in the past two months. On June 15, Hoa Phat adjusted the price of CB240 coil to 14.29 million VND/ton, the price of D10 CB300 rebar to 14.69 million VND/ton, down 200,000 VND/ton.

Other brands such as Vietnam Italy, Viet Duc, Viet Nhat, Pomina also lowered the price of the two above steels similarly. Thus, from the beginning of April until now, steel price has dropped 11 times in a row with a cumulative decrease of nearly 3 million VND/ton.

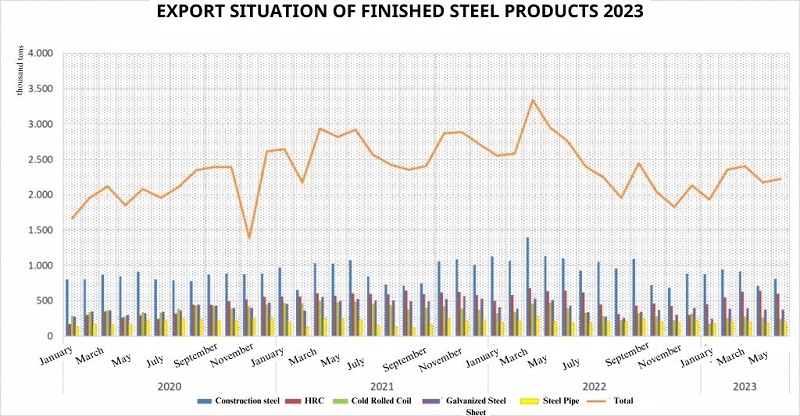

The continuous reduction of steel prices by factories aims to improve production and consumption in the domestic market. Data from VSA shows that in May 2023, the whole country produced more than 2.2 million tons of finished steel, up 2.3% over the previous month. Domestic consumption volume also recorded more than 2.3 million tons, up 13.6% compared to April and tended to continue to increase.

Regarding the export situation in the first quarter of 2023, Vietnam sold about 2,299 million tons to foreign countries with a total value of 1.72 billion USD. Currently, Vietnam exports iron and steel to 30 markets, mainly ASEAN (36.38%), the EU (24.15%), the US (7.55%), India (5.72%) and Turkey (3.21%).

2. Asia to drive steel demand recovery 2023-2024

According to the World Steel Association, the main indicators of the real estate construction industry may increase by the end of 2023 but still not significantly. Meanwhile, infrastructure investment is tending to shift to projects that focus on less steel. China's steel demand is expected to recover 2%, reach 939.3 million tons in 2023 and stay flat in 2024.

Structural steel demand in ASEAN markets recorded a strong increase. Recovering from the Covid-19 pandemic, Indonesia, the Philippines, and Vietnam began to restart delayed tourism and infrastructure projects. It is expected that the growth in steel demand of ASEAN will reach 77.1 million tons, up 6.2%, while in 2024 may increase by 5.7%.

Overall, worldsteel expects steel demand in 2023 to increase by 40.8 million tons, reaching $1,8223 billion. In which, China contributed 18.4 million tons, ASEAN 4.5 million tons, Japan 2.2 million tons and South Korea 1.5 million tons.

3. Steel prospect in developed and developing economies

Steel demand in developed economies such as Europe, the United States, Russia, Turkey,... has suffered a sizable contraction due to the effects of the Russia-Ukraine conflict, high energy costs and monetary tightening. After a decrease of 6.2% in 2022, the steel situation is expected to be more positive with an increase of 1.3% in 2023 and 3.2% in 2024.

3.1. European Union and United Kingdom

Despite being significantly affected by the energy crisis caused by the Ukraine war, the EU's economy grew steadily by 3.5% in 2022. However, industrial activities still suffered significant losses due to high energy costs leading to a significant reduction in steel demand in 2022. In 2023, the EU steel industry is still facing many difficulties due to supply chain disruptions and currency tightening, expected to fall by 0.4%. A 5.6% rebound is expected in 2024.

3.2. USA

The US economy has taken a strong turn after the pandemic with the recovery and growth of the manufacturing and energy industries. Benefiting from the expansion of manufacturing operations, US steel demand in 2023 is expected to grow by 1.3% and then by 2.5% in 2024.

3.3. India

According to the World Steel Association, India is still a bright spot in the global steel industry in 2023 thanks to managed inflation well. The automotive and consumer durables sectors are expected to grow steadily, leading to a healthy growth in steel demand at 7.3% in 2023 and 6.2% in 2024.

With the forecast of steel demand growth in developed and developing economies in the period of 2023-2024, it will help importers to have the most effective purchase plan. Don't forget to follow MRS Steel to keep up to date with the latest news about Vietnam and the world's steel industry. Any need to import steel from Vietnam, please contact Whatsapp: +84 76 911 2358 for the best support from MRS Steel.