Outlook for global steel demand in 2023 & 2024 - Positive growth despite challenges

Steel NewsDate: 22-11-2023 by: Ngan Le

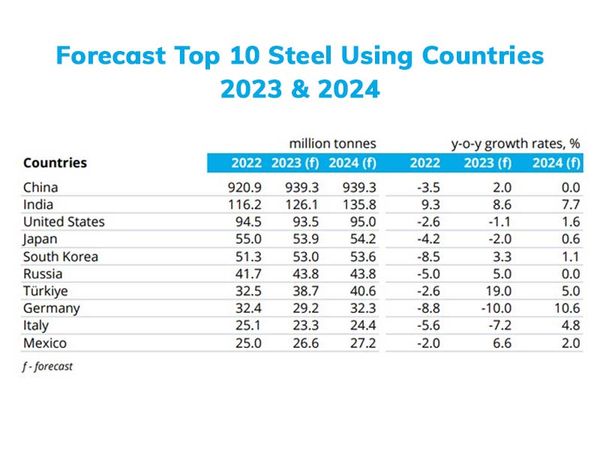

The World Steel Association (worldsteel) forecasts that global steel demand will increase by 1.8% in 2023, reaching a consumption of 1,814.5 million tons after a 3.3% decrease in 2022. Furthermore, experts anticipate an additional 1.9% rise in steel demand in 2024.

Overview of steel demand prospects for 2023 - 2024

According to the latest forecast data released by the World Steel Association for global steel demand in 2023 and 2024, despite challenges in the real estate sector and strong impacts from tightened monetary policies, steel demand is projected to increase by 1.8% in 2023, reaching a consumption milestone of 1,814.5 million tons. In 2024, steel consumption is expected to further grow by 1.9% with a value of 1,849 million tons as inflation begins to ease in 2023, this is also a significant factor in ending the monetary tightening cycle by 2024.

Outlook for steel demand in China - the world's largest steel production facility

The prolonged real estate market downturn from the previous year to 2023 has burdened this densely populated country's economy, directly affecting domestic steel consumption. Most steel-consuming sectors have shown signs of weakening since Q2 2023, particularly key real estate indices such as land sales, home sales, and new construction starts continuing to decline. The consecutive decline in construction commencement projects during the 2022-2023 period will constrain construction activities and reduce steel demand growth in 2024.

However, the outlook is expected to stabilize by the end of 2023, as infrastructure investment projects are showing moderately positive signs due to government efforts in construction since July 2023. Anticipated steel demand in China for 2023 is projected to grow by 2%, reaching a consumption of 939.3 million tons of finished steel, primarily driven by government support in infrastructure investments. Overall, the real estate market and exports will likely continue to exert pressure on steel demand, making the prospects for 2024 uncertain and at risk of decline if stimulating policies are not more effective than anticipated.

Steel demand prospects in developed economies

Steel demand in developed economies including the USA, the EU, Japan and South Korea is forecasted to decrease by 1.8% in 2023. The European region, in particular, heavily affected by tight monetary policies and soaring energy costs due to the conflict between Russia and Ukraine, has reduced residential construction projects, stalling manufacturing activities. With forthcoming challenges, steel consumption in the European Union is forecasted to decline by 5.1% in 2023 to 144.3 million tons. In contrast, amidst high-interest rates and energy costs impacting steel producers, the EU is banking on an automotive manufacturing recovery, expecting positive steel demand growth in 2024, estimated at 5.8%.

Similarly, the US is also affected by steeply rising interest rates. Residential construction activities will decline in 2023 and throughout 2024. Instead, commercial construction sectors are showing signs of recovery under supply chain resurgence. Hence, steel demand is projected at 93.5 million tons, a 1.1% decrease in 2023 and a subsequent 1.6% growth in 2024.

Steel demand prospects in developing economies

In contrast to trends in developed economies, steel demand in developing economies, including India, ASEAN, the Middle East, Russia, Turkey and Latin America, shows robust growth in 2023 with a 4.1% increase and a subsequent 4.8% surge in 2024.

India notably stands out with remarkable steel consumption growth due to stable economic conditions despite high-interest rate pressures. Government investments and spending in infrastructure have significantly propelled growth in the construction sector. Besides construction stability, steel consumption is boosted by the automotive and consumer goods sectors. After a 9.3% growth in 2022, steel demand is projected to grow by 8.6% (126.1 million tons) in 2023 and 7.7% (135.8 million tons) in 2024.

The Middle East and North Africa anticipate reduced steel consumption in 2023 with a negative 3.5% growth due to sluggish construction in Saudi Arabia and Qatar. However, steel demand is expected to rebound in 2024, driven by numerous infrastructure projects and pent-up housing demands from the previous year. Turkey's steel demand records an exceptional 19% growth in 2023, with an estimated consumption of 38.7 million tons, likely to continue growing by 5% in 2024. Steel demand in Latin America is forecasted to increase by 1.4% in 2023 and subsequently by 2.1% in 2024. Issues concerning rising interest rates and inflation are no longer prevalent in this region as some countries have initiated monetary policy relaxations. Particularly in Mexico, consumption appears more optimistic, especially in steel-intensive manufacturing sectors like automotive.

The ASEAN region also shows promising signals with steel demand growth at 3.8% in 2023 and 5.2% in 2024. Domestic infrastructure and real estate investments largely drive steel demand despite ongoing inflation. Furthermore, steel consumption in some countries is stimulated by expanding new export markets, notably Vietnam - showcasing positive trends in exporting finished steel, HRC and galvanized steel.

Here is all the information compiled by MRS Steel regarding the global steel demand prediction sourced from data provided by the World Steel Association (worldsteel). MRS Steel is currently a leading trustworthy steel solutions provider for Vietnam's importers in the region. If you have any inquiries about the Vietnamese steel market, market price information, please contact us via email at vanloc@mrssteel.com.vn or WhatsApp: +84 76 911 2358.