The Indian steel industry faces challenges in the supply of scrap steel

Steel NewsDate: 09-11-2023 by: Ngan Le

India's target to double its steel production capacity to 300 million tons by 2030 may face difficulties due to recent restrictions on scrap steel exports by the European Union. This move could directly disrupt the Indian steel industry as the country hasn't developed a strong recycling industry and relies heavily on imported scrap steel for production.

The production capacity of Indian steel industry facing limitations by shortage of scrap steel supply

India is currently the world's second-largest producer of crude steel after China, with 124.7 million tons of crude steel in 2022. In a conference in February 2023, the Indian government set the target of increasing steel production capacity to 300 million tons by 2030. "The current 15% scrap usage will increase to nearly 25% within the next 5 years, meaning that the proportion of scrap used in steel production will increase to 50%," as stated by the Indian Steel Minister in the MRAI Material Recycling Conference 2023.

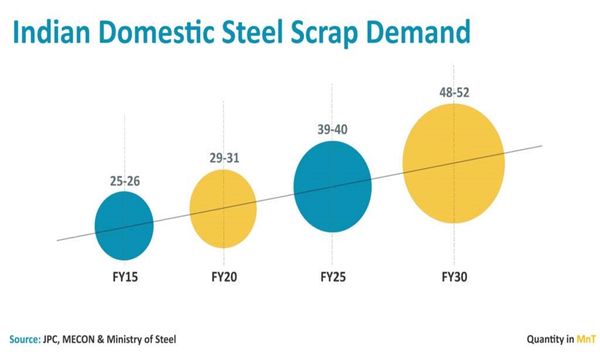

Analysts predict that India's ambitious production growth target will lead to a significant demand for scrap materials. Specifically, by 2030, the demand for scrap materials is projected to reach 65 million tons per year, while the domestic scrap supply at that time is only 59 million tons per year. This raw material shortage will force the Indian steel industry to rely more on imported scrap materials to fill the gap.

Forecast chart of India's scrap steel consumption demand until 2030

Therefore, in 2021, the government attempted to expand the scrap steel industry by utilizing vehicles. Specifically, vehicles over 20 years old had to undergo emissions tests, and if they failed, they were recommended for disposal and used as a source of scrap steel for the manufacturing industry. Implementing the policy of collecting scrap steel from vehicles could provide the steel industry with an average of 6 million tons per year. While the policy may address recycling supply needs, in the long term, it has not achieved effectiveness because most recycling infrastructure in India is still in its early stages, and there are still very few old vehicles available for disposal.

The new challenge comes from the import of scrap steel

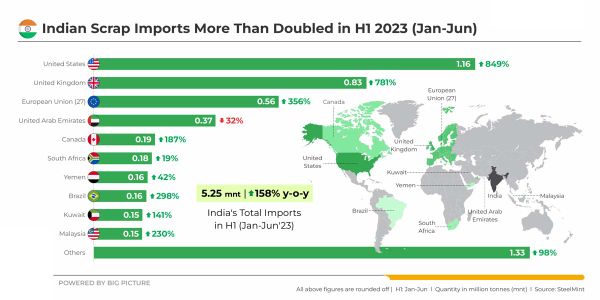

To enhance the supply of scrap steel for production, the current import plan is considered the most feasible approach while the number of steel recycling plants in the country is being limited. In 2022 alone, India spent over 12 billion USD on importing metal scrap, and within the next 5 to 6 years, India is expected to become the world's largest importer of scrap steel, with imports reaching approximately 20 million tons by 2030. Currently, India is ranked as the second-largest scrap steel importer in the European Union, as well as in the United States, Asia, and the Middle East.

Top Indian exporting scrap steel countries in the first 6 months of 2023

However, India's ambitious import plan to expand steel production is facing several challenges. The European Union, a significant market for supplying scrap steel to India, is considering imposing restrictions on the export of metal scrap to reduce emissions and protect the environment. Additionally, major scrap steel exporters like the United States, Asia, and the Middle East are also contemplating export restrictions to preserve this valuable resource. Import barriers for scrap steel have hindered the Indian steel industry’s target to double its steel production capacity, forcing steel producers to search for alternative supply sources.

The Indian steel industry is confronted with numerous challenges in addressing the scrap steel supply issue due to strict scrap steel export policies from the European Union. Nevertheless, the country is working on improving its recycling capacity by building a series of steel recycling plants starting in 2021. Although there are still many obstacles to increasing production capacity, India continues to seek new opportunities to expand its steel industry.

In recent years, trade relations between Vietnam and India have been strengthening, particularly in the steel sector. India is considered a potential export market for Vietnam, with increasing demand for scrap steel and hot-rolled coils (HRC). In the first 9 months of 2023, India unexpectedly became the second-largest importer of HRC from Vietnam, with a production volume exceeding 386,000 tons. Based on infrastructure construction needs and the ambition to secure raw materials for production from India, the Vietnamese steel industry expects to expand its export market in the future, especially with HRC being one of its key products.