The Vietnam’s HRC export volume reached over 3.4 million tons in 2023

Steel NewsDate: 25-01-2024 by: Ngan Le

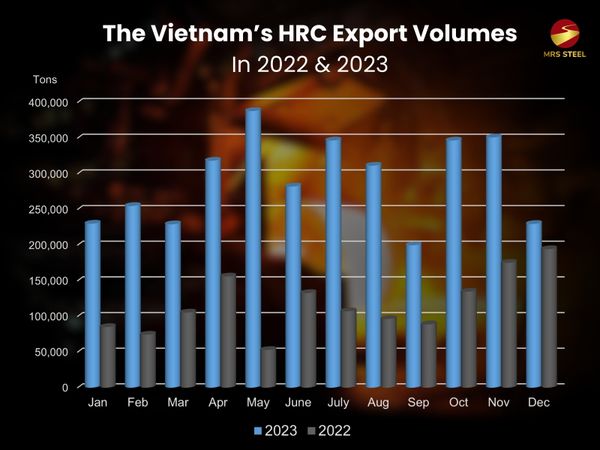

In the past 2023, Vietnam's HRC export volume recorded exceeding 3.4 million tons, marking a 2.6-fold increase compared to 2022. In December alone, the HRC export volume reached 229 thousand tons, experiencing a 34% decrease compared to November but a significant 19% increase compared to the same period in 2022.

Overview of Vietnam's HRC export situation in 2023

While domestic steel consumption is perceived as sluggish due to low demand and the domestic real estate sector still showing few signs of recovery, the export volume is considered a rare bright spot in the overall challenging landscape of the steel industry in 2023. Specifically, the sales of HRC in 2023 reached 6.8 million tons, a 10% increase compared to 2022, constituting nearly 26% of the overall steel consumption structure in 2023.

Prominent in this field is the HRC export sector, significantly contributing to the overall achievements of the industry. With a figure of 3.4 million tons, the HRC export segment not only accounted for over 50% of the total sales volume but also recorded an impressive 2.6-fold increase compared to the same period in 2022. This is not only a positive sign of the competitiveness of the steel export industry but also reflects innovation and creativity in business strategies, enabling the Vietnamese steel industry to rise above challenging circumstances.

The Vietnam’s HRC export volumes by month in 2022 and 2023

Formosa Ha Tinh and Hoa Phat continue to maintain their leading and second positions in the production and export of HRC (hot-rolled coil). Formosa's HRC export volume in 2023 reached 2.2 million tons, surging by 46% compared to the export volume in 2022. Additionally, HRC was the only product that recorded positive sales growth for Hoa Phat, with a total volume of 2.8 million tons, a slight 6% increase compared to 2022, including an HRC export volume of 1.15 million tons.

Among steel products, hot-rolled coil stands out as the product with the most robust growth. Some experts believe that the hot-rolled coil (HRC) market will recover more quickly due to ongoing strong consumption, especially in the mechanical and processing industries. Compared to construction steel, hot-rolled coil (HRC) not only offers more attractive pricing but also reflects a significant price disparity due to the construction industry's ongoing difficulties and substantial impact from the real estate market, while the mechanical and manufacturing sectors show better signs of recovery.

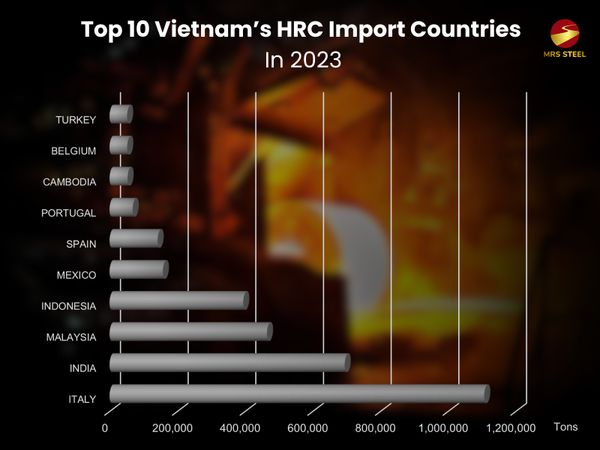

India and Italy are the two main HRC import markets for Vietnam

Based on customs data, Italy and India emerge as the two largest HRC import markets for Vietnam in 2023. Italy, in particular, imported 1.1 million tons of HRC steel from Vietnam in the past year and in December alone, it continued to lead the HRC import market with a volume of 80,470 tons. Alongside Italy, India became the second-largest importer of HRC for Vietnam, with a total HRC import volume of 694,000 tons in 2023.

Although India has been evaluated as a potential steel import market and consistently maintained its position as Vietnam's largest HRC importer in previous months, its import volume significantly decreased in December, plummeting over 85% compared to the previous month, reaching 20 thousand tons. Sources indicate that the primary reason for this decline is the anticipated reduction in India's domestic demand for hot-rolled coil steel, mainly attributed to the upcoming general elections causing disruptions in pricing. Currently, the country's mills are seeking solutions to address excess production by increasing exports to the European market.

Top 10 countries with the largest imports of Vietnam's HRC in 2023

Malaysia and Indonesia consistently stand out as two countries with stable HRC import volumes from Vietnam, regularly appearing in the top 5 largest HRC importers each month. In 2023, the HRC import volumes for Malaysia and Indonesia reached 464,874 tons and 394,786 tons, respectively. Additionally, in the top 10 HRC importers list, Mexico is the sole representative from the Americas with an import volume of 157,322 tons, while other predominantly European countries include Spain, Portugal, and Belgium.

Predictions for the future of Vietnam's HRC export market in 2024

The predominance of countries in the European region on the list of HRC importers for Vietnam in 2023 somewhat reflects the competitiveness and quality of Vietnamese steel products in the strategic expansion of export markets and shaping Vietnam's international steel industry position. However, the rankings on this list are expected to undergo significant changes in 2024, particularly among European countries.

According to the customs statistics of the EU, as of January 5th, approximately 1.18 million tons of imported HRC are awaiting customs clearance in the EU for the first quarter of 2024, while the permitted quota is 923,594 tons. Within this quantity, the majority consists of shipments from Vietnam, Japan and several other countries. Under the EU's protective measures, any steel products imported beyond the quota will incur tariffs of up to 25%, unintentionally posing a new challenge for the export dynamics of Vietnamese HRC in 2024. Therefore, domestic HRC manufacturers will need to promptly adjust and implement new strategies to maintain their export market share and explore new consumer markets.

MRS Steel regularly updates comprehensive information on HRC export volume and the list of importing countries in 2023 based on the latest customs data. If you have further inquiries about specific figures or weekly steel price lists directly from the factories, please contact us via WhatsApp at +84 76 911 2358 or email vanloc@mrssteel.com.vn for the fastest response possible.