Vietnam’s scrap steel imports increase more 25% in November

Steel NewsDate: 26-12-2023 by: Ngan Le

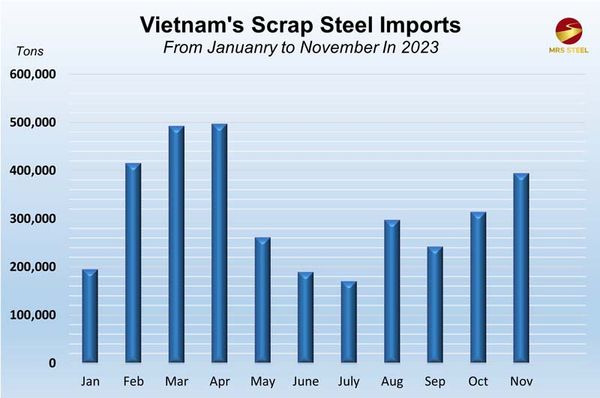

According to the latest data from the General Department of Customs of Vietnam, Vietnam's scrap steel imports volume in the past November unexpectedly reached 392,189 tons, a 25.8% increase compared to the previous month (over 312,000 tons of scrap in October). Cumulatively, in the 11 months of 2023, the total imported scrap amounted to 3.87 million tons, experiencing a slight decrease of 2.2% compared to the same period last year (3.96 million tons).

Japan remains be the largest supplier of scrap steel to Vietnam in 2023

Japan has consistently maintained its position as the primary provider of Vietnam scrap steel imports since 2018. In November alone, Japan supplied Vietnam with 212,438 tons of scrap steel, a remarkable increase of 241.4% compared to the same period last year. For the cumulative 11 months of 2023, the imported scrap volume from Japan reached over 1.436 million tons, constituting more than 40% of Vietnam's total scrap steel imports. In comparison to the same period last year, the import volume for the first 11 months of this year increased by 16%. Notably, Vietnam has focused on sustaining and enhancing its supply of scrap steel from Japan, despite the upward trend in scrap steel prices from Japan, which, as of December 2023, has reached $348 per ton in export prices.

The imported scrap steel volume of Vietnam from January to November 2023

Besides Japan, the United States stands as the second-largest market with a consistently high volume of scrap steel imports each month. Specifically, in November, Vietnam imported 48,515 tons of scrap steel from the United States, marking a 30.9% increase compared to the same period last year. Overall, for the first 11 months of 2023, the import volume of scrap steel from the United States reached 874,693 thousand tons, showing a slight 3% increase compared to the same period in 2022.

Additionally, in the list of primary suppliers of scrap steel to Vietnam in November, Hong Kong and Australia were also notable contributors, with volumes reaching 38,874 tons (a 49% increase compared to the same period) and 9,265 tons (a remarkable 241.4% increase compared to the same period last year), respectively. In the first 11 months of 2023, Hong Kong's total export volume of scrap steel to Vietnam reached 377,303 tons, experiencing a slight 1.2% decrease compared to the same period last year. Similarly, Australia's supplied volume of scrap steel to the Vietnamese market for the first 11 months reached 236,266 tons, reflecting a 16% decrease compared to the same period.

The demand for Vietnam’s scrap steel imports is expected rise in December

The unexpected surge in scrap steel imports has been surprising, given that Vietnamese steel producers have largely maintained stable scrap imports over the past 10 months due to a prolonged slowdown in the domestic real estate sector. While some factories have reduced capacity and prioritized domestic scrap sourcing, larger-scale facilities continue to require substantial raw material imports. These factories anticipate a resurgence in steel demand after the lunar holiday, contributing to the anticipated growth in scrap steel imports in December.

Another factor contributing to the increase of Vietnam's scrap steel imports comes from the country's recent open foreign policy. Many steel items, especially imported scrap steel, have seen a significant surge, partly to meet the needs of Vietnamese manufacturers and also due to the advantages of enjoying a 0% tax rate coupled with the removal of trade protection measures.

The substantial increase in import demand has positioned Vietnam as a significant player in the global scrap steel import market this year. This strategic move not only helps meet domestic demand, especially for large-scale steel plants requiring extensive raw materials to maintain production and capacity stability, but also serves as a strategy to strengthen Vietnam's position in the international steel market. Through this approach, Vietnam can demonstrate its strength and competitiveness in the field of raw materials and steel production.