Overview and forecasts for global scrap steel consumption

Steel NewsDate: 12-12-2023 by: Ngan Le

Scrap steel is an important raw material used in production, especially with the recent strong trend of environmental protection. In 2023, the scrap steel consumption showed unfavorable indices; however, simultaneous forecasts consistently indicate the industry's recovery and growth in the coming years.

Global scrap steel consumption overview 2023

According to the Bureau of International Recycling (BIR), the global market for scrap steel consumption faced challenges in the first half of 2023, experiencing decreased consumption across various countries and major regions compared to the same period last year. Additionally, global scrap imports in the first half of the year decreased by 8%, totaling 27 million tons compared to 2022.

The decline in global scrap steel consumption and imports is directly related to the reduction in steel production this year, as the primary purpose of utilizing scrap steel comes from manufacturing. Specifically, global steel production in the first half of the year decreased by 1.1%, reaching 943.9 million tons. Significant regions experienced even more negative indices, notably with EU steel production dropping by 10.9% from January to June, and North America showing a 3.5% decline.

Despite a 2.9% decrease in the utilization of scrap steel, China remains the largest consumer of scrap steel in the first half of 2023, reaching 116.2 million tons. Similarly, the top three countries leading in scrap steel import volumes in the first half of 2023 were Turkey at 9.6 million tons (a 22% decrease compared to the same period), followed by India at 5.25 million tons and the United States at 2.5 million tons.

Notably, Turkey, previously a significant consumer of scrap steel (30 million tons in 2022), experienced a 16.4% decrease in scrap steel imports in the first nine months of 2023, reaching only 14.1 million tons. Reports indicate that the majority of Turkey's scrap steel imports were sourced from the EU. However, since 2022, Turkey's consumption of scrap steel has declined due to domestic demand and challenges in flat steel exports amidst increasing inflation and a depreciating lira.

Scrap steel consumption prospects in coming years

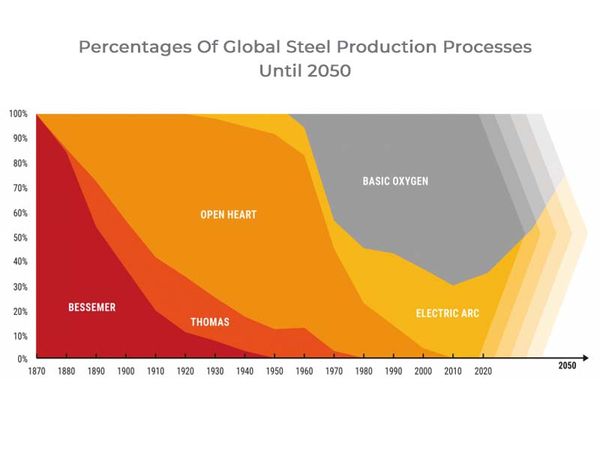

Amidst the global steel industry's focus on reducing carbon emissions from steel production, scrap steel is viewed as a strategic raw material to achieve carbon neutrality among steel manufacturers. Using scrap steel in electric arc furnaces (EAF) is the most straightforward approach to reducing CO2 emissions.

Presently, increasing investments and EAF usage signify optimistic future consumption trends for global scrap steel. The current percentage ratio between basic oxygen furnace (BOF) and EAF steel production stands at 70/30. However, predictions suggest a shift to 60/40 by 2030. The EU is preparing to include scrap steel in the list of strategic raw materials in the green steel production trend. According to the International Rebar Producers and Exporters Association (IREPAS), EAF proportions in steel production in Europe, currently at 43.7%, are anticipated to significantly increase in the next 3-5 years.

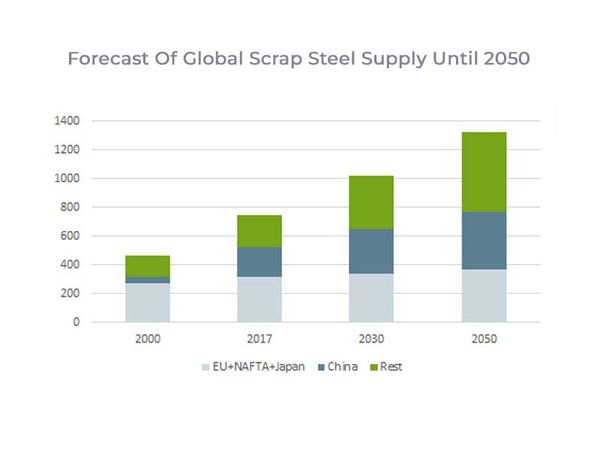

China also aims to enhance scrap steel utilization in production to reduce reliance on imported iron ore and lower carbon emissions. According to the Ministry of Industry and Information Technology (MIIT), the country could achieve EAF capacities of 100-200 million tons by 2030. The growth in scrap steel consumption is estimated to surge, from 260 million tons in 2022 to over 350 million tons by 2030.

As of now, the EU remains one of the largest exporters of scrap steel, with approximately 9 million tons exported in 2023. However, some viewpoints suggest that the shifting production trends among European steel suppliers may transform the region into a primary scrap steel importer within the next 5 years. This could increase the demand for imported scrap steel to serve new production processes, transitioning the region from an export-driven role to a scrap steel importer.

It is evident that in the near future, most countries will prioritize domestic scrap steel consumption rather than exports. However, current scrap collection rates fail to meet annual production needs, prompting countries to compete in accessing scrap steel sources through recycling initiatives or imports from other nations. This trend could simultaneously create new opportunities for countries to advance recycling industries and establish cleaner and more efficient steel production processes in the future.