Vietnamese steel import and export situation in October 2023

Steel NewsDate: 23-11-2023 by: Ngoc Cam

According to statistics from the General Department of Customs, Vietnam's iron and steel exports of all kinds in October 2023 reached 908,142 tons, an increase of 5% compared to September and a sharp increase of 71.5% compared to the same period in 2022. Vietnam is aggressively penetrating major markets like the United States, India, Italy, Singapore,… offering extremely competitive prices.

1. Vietnamese steel export situation 10M/2023

According to the General Department of Customs, accumulated in the first 10 months of 2023, Vietnam's iron and steel export output of all kinds reached over 9.1 million tons, equivalent to 6.95 billion USD, up 30.7% in volume and up 0.1% in value compared to the same period last year. The average export price of 10M/2023 reached 760 USD/ton, down 23.4% over the same period last year.

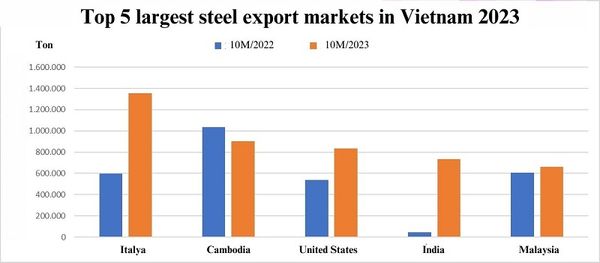

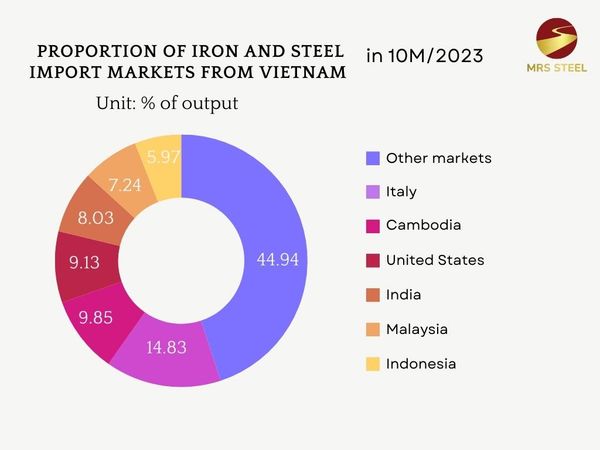

By the end of October 2023, the 10 largest Vietnamese steel import markets were Italy accounting for 14.8%, Cambodia (9.9%), the United States ( 9.1%), India (8%), Malaysia (7.2%), Indonesia (6%), Belgium (5.4%), Spain (3.9%), Taiwan (3.4%) and Thailand (3.1%).

2. Bright spots in Vietnam's steel exports

2.1. Southeast Asia region

Southeast Asia is still the main export market of Vietnam's steel industry, accounting for 31.5% of the proportion. However, in the first 10 months of 2023, exports to this market decreased slightly by 2.6% compared to the same period in 2022, mainly due to down 13% in exports to the largest market, Cambodia. In contrast, exports to markets like Malaysia, Indonesia, Thailand and Singapore still increased compared to the same period last year.

2.2 EU market

The highlight in the steel export situation in the first 10 months of 2023 is the EU market has positive growth rates compared to the same period in 2022. Specifically, Italy imported the most steel from Vietnam with over 1.35 million tons, an increase of 128%, followed by Belgium with 0.49 million tons, an increase of 30% and Spain imported 0.35 million tons, an increase of 70.2%.

According to the European Steel Association (EUROFER), Vietnam accounted for 8.1% of the total amount of finished steel products imported into Europe by the end of August 2023. Another positive signal for Vietnam's steel industry is that Europe's imports of finished steel products from Turkey, China and India decreased sharply (-59%, -11% and -3% respectively) while imports from Vietnam increased by 15%.

2.3. Indian market

Notably, steel exports of all kinds to India in October reached 198,418 tons, worth 139.6 million USD, an increase of 2,346% in volume and an increase of 1,103% in turnover compared to October 2022. This is also the month recording the highest export output since the beginning of 2023.

In the first 10 months of 2023, India has become Vietnam's 4th largest steel export market with a total output of over 0.73 million tons, a value of over 539.7 million USD, an increase of nearly 16 times in volume and an increase of 7.8 times in value compared to the same period in 2022. The main export items were hot-rolled steel coils and galvanized steel sheets, of which HRC is a new product that India has not imported from Vietnam in the 2021/2022 financial year.

2.4. Cambodian market

Cambodia, Vietnam's largest steel export market in 2022, dropped to second place in 2023 due to a decrease in both output and export turnover. As of October 2023, Vietnam's iron and steel export turnover to Cambodia reached 612.7 million USD, down 26% over the same period last year; Exported iron and steel output reached over 0.9 million tons, down 13% over the same period. The main export product to Cambodia is mainly construction steel. According to exporters, the amount of construction steel exported to Cambodia decreased partly due to the impact of the COVID-19 pandemic on the real estate market.

Vietnam's steel exports have many signs of recovery and positive development in the fourth quarter and early 2024. Many importers from major markets such as the US, EU, UK and India pay a lot of attention to cheap, quality steel from Vietnam. However, in the context of many fluctuations in the world's economic and political situation, the Vietnamese and global steel industry can still experience many sudden changes. You can follow MRS Steel to update the latest steel market information!